Hyperinflation On The Horizon

How pandemic policies and bank collapses could cause global hyperinflation

Hyperinflation turns economies into chaos, causing widespread poverty, social unrest, and political instability.

Imagine post-World War I Germany, where prices would double every seven hours and you needed a wheelbarrow of cash to buy a loaf of bread. Or in 2009 Zimbabwe, when people had to resort to barter as inflation peaked at 89.7 sextillion per cent (that's 89.7 followed by 21 zeros!)

Studies have shown that five of the most common warning signs are:

Economic shocks

Excessive money printing

Uncontrolled debt

Political instability

War

Let's dive into each of these red flags.

1. Economic shocks

Economic shocks can cause hyperinflation as governments and central banks resort to drastic measures to protect people from financial hardship.

Stock prices are down around 15% in 2023, more than 100k employees have been laid off from tech companies in the US, housing markets are crashing, and three US banks have collapsed in the past few weeks alone.

Increased interest rates and quantitative tightening (QT) in an effort to reduce inflation have driven banks like Silicon Valley Bank (SVB) to ruin. Just this week in Europe, Credit Suisse had to be bailed out by the Swiss central bank.

Quantitative tightening: when central banks reduce the money supply by selling financial assets, which can lead to higher interest rates and slower economic growth.

Given all of the above, it's safe to say much of the world is amid an economic shock at the time of writing this. Solutions are limited, and drastic hyperinflationary measures are likely to be employed.

2. Excessive money printing

One such drastic measure is money printing. Money printing, also known as quantitative easing (QE), has had to resume to backstop failing banks and insure customer deposits.

Quantitative easing: when central banks purchase assets such as government bonds from banks, increasing their reserves and, in turn, allowing them to lend more money to businesses and individuals.

QE has been employed heavily since The Great Financial Crisis of 2008 but went into overdrive during the pandemic. The US government has printed over $8 trillion since 2020. To put that into perspective, the total printed during WW2 is estimated to have been just $2.5 trillion in today's buying power and the total printed during The Great Financial Crisis of 2008 was $4 trillion.

Given the latest bank bailouts and future collapses expected, this $8 trillion will likely continue to grow and drive inflation. JP Morgan estimated that the latest bailout programme could cost as much as $2 trillion. This has effectively reversed almost half a year of QT, which led to the bank crisis in the first place.

3. Uncontrolled debt

QE soothes the economy but causes inflation. QT reduces inflation but hurts the economy. The world's central banks are stuck between a rock and a hard place. But what's worse is the higher interest rates that accompany QT also increase the national debt.

The result is a feedback loop where the rising debt's interest cost prompts governments to take on more debt. This downward spiral can lead to exponential snowballing of debt across the board, as observed in many parts of the world.

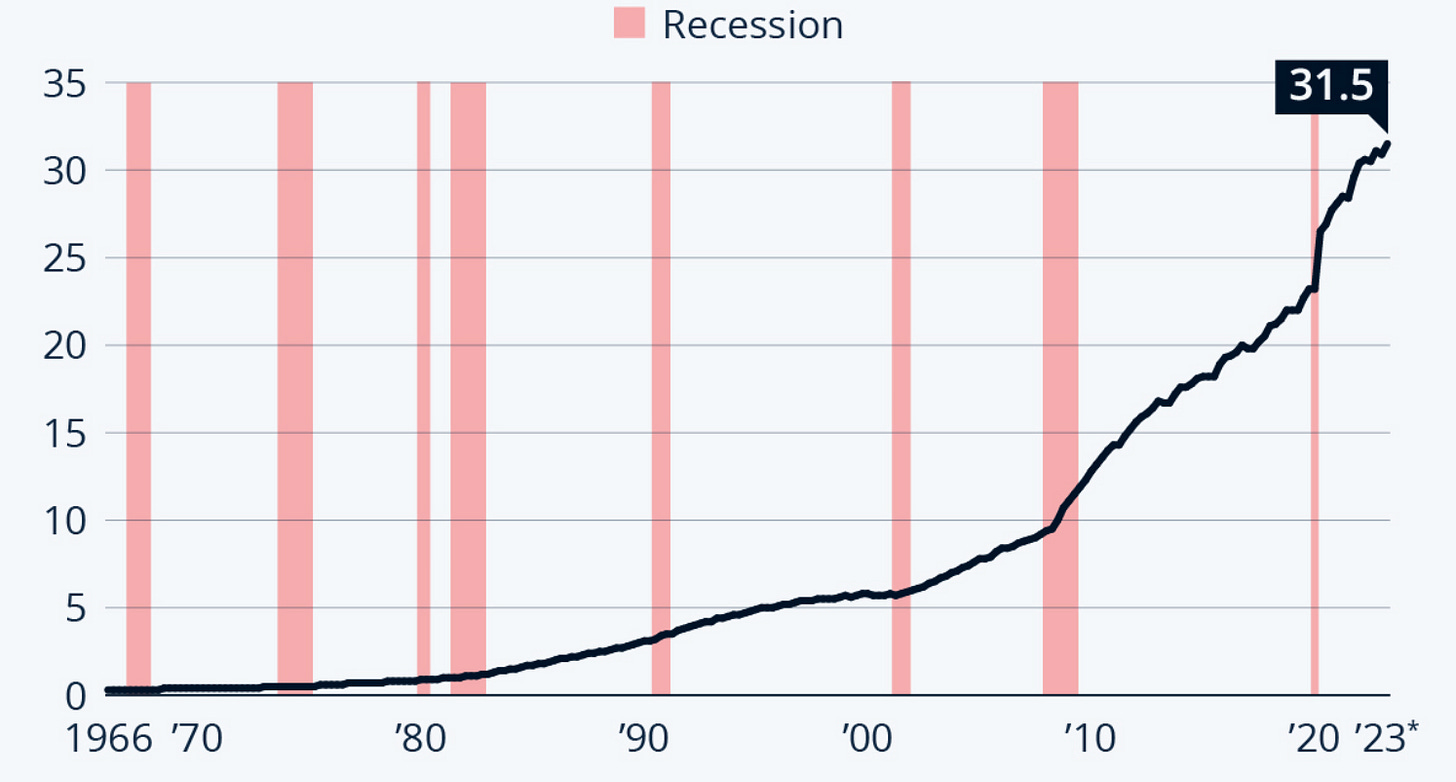

The pandemic forced the national debt to surge as governments borrowed money to support people and businesses while the economy shut down. US national debt is $31.5 trillion, almost $250,000 for every American taxpayer. The situation is similar in the UK, Europe, and much of the world. Global debt has hit $300 trillion, which is over 3x of the GDP of the world as a whole.

The US government has had to increase the debt ceiling 78 times since the 1960s to avoid defaulting on the national debt, with the latest attempt to do so going on right now. If governments continue to print money to pay the interest, it will drive us closer to hyperinflation.

4. Political instability

During 2020 riots took hold in the USA; police were attacked, buildings were burned down and people were killed. If you turned on the news, you would see Mad Max-like scenes of lawless autonomous zones where anarchists patrolled the police-free streets of Seattle with assault rifles. In 2021 protestors stormed the Capitol building in an attempt to overturn the results of the election.

This year in Europe, strike action is bringing infrastructure to a halt in the UK. In France, protestors continue to clash with police over pension reforms. Over 400 significant antigovernment protests have occurred worldwide since 2017, many of which have turned violent.

Many of these protests are caused by macroeconomic headwinds. For example, the French riots are linked to raising the pension age, a necessity due to an increasingly unaffordable pension system. The UK strikes result from public sector wages struggling to keep pace with spiralling inflation.

When people can't afford to heat their homes or put food on the table, it doesn't take much to spark political extremism. Hitler's rise to power in Weimar Germany would have been fraught had it not been for the hyperinflationary environment driving people to political extremes.

But political instability also leads to hyperinflation, as desperate governments turn to drastic economic measures to either fight or appease rebellious citizens.

5. War

What is it good for? Hyperinflation.

We are now in the second year of the Russian invasion of Ukraine. Although officially a war between two countries, much of the world has been drawn in both geopolitically and economically. The USA has sent more than $30 billion in financial aid and even more in weaponry to Ukraine since the outset, as has the rest of NATO and Europe. This spending forces nations to take on more debt and QE.

The war has also caused inflationary pressures on supply chains. Ukraine is considered the bread basket of the world, and food costs have skyrocketed as a result. Russia is one of the world's leading suppliers of energy and the resulting European energy crisis has led to governments having to borrow and print even more to subsidise citizens’ energy bills.

The risks of a China invasion of Taiwan have also heightened lately. A conflict which would likely drag the USA in much deeper than the invasion of Ukraine and destroy much of the world's trade and supply chains.

We have never been closer to a third world war. War causes hyperinflation by destroying trade and supply chains, increasing commodity prices, and forcing nations to spend heavily on defence and aid.

Where do we go from here?

The fallout from the pandemic led to unprecedented economic policies worldwide, forcing us between a rock and a hard place. Inflation is high, debt is unsustainable and economies are wavering. QE would cause more inflation, QT could crash the economy.

Whether we can avoid hyperinflation remains to be seen, but it’s definitely on the horizon. The decisions made today will profoundly impact the economic future of generations to come.

On the bright side, we have Apple Pay now - you won't need a wheelbarrow for those expensive loaves of bread!