The Largest Bank Collapse Since The Great Financial Crisis

Why did Silicon Valley Bank collapse, and will it wreck the economy?

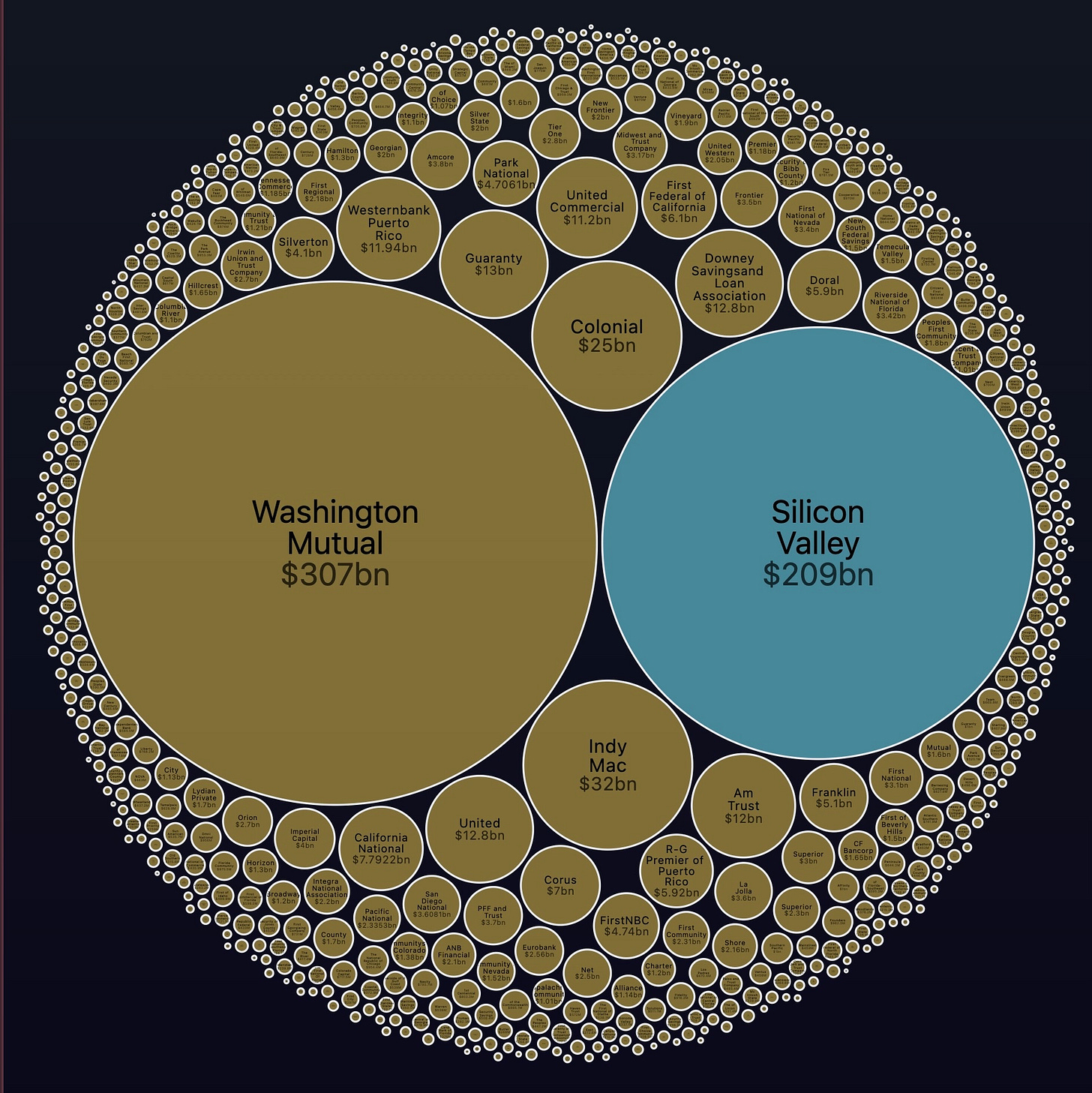

Silicon Valley Bank (SVB) made a splash this week by winning the coveted 'second-largest bank failure in US history award’, coming in just behind Washington Mutual's collapse in the 2008 great financial crisis. The bank once held over $200 billion in assets and was valued at more than $44 billion just 18 months ago.

A classic bank run triggered the collapse, as panicked customers raced to withdraw over $42 billion in deposits in a single day.

In this article, we'll examine why bank runs occur, what caused this one in particular, and why it may serve as a spark for the next major financial crisis.

What is a bank run?

Before we get into what happened, it's essential to understand the concept of bank runs. Bank runs occur when numerous people withdraw their funds due to fear the bank might fail.

Similar to the toilet paper crisis during the Covid pandemic, a feedback loop develops when the hurry to withdraw cash causes the bank to flounder. This flounder, in turn, fuels the hysteria, leading more customers to rush for the exit.

So, why does this happen? Well, it's all thanks to the magical world of fractional reserve banking. When you deposit your money, banks only have to keep a fraction of it available (10% in the USA) while they lend the rest to collect interest. If too many people show up demanding their money back, the bank won't have enough cash on hand.

What happened to SVB?

Central banks worldwide have sharply lifted interest rates over the past year in an attempt to curb inflation. I recently wrote about how this would damage the markets, and now we have a great example.

SVB incurred a $1.8 billion loss from selling an unprofitable bond portfolio. A failed attempt to raise capital to fill the hole spooked investors, and the stock price collapsed by 60%.

Investors, startups, and tech employees scrambled to withdraw their funds, fearing the bank’s collapse. In just one day, $42 billion was removed, representing almost a quarter of the bank's total deposits.

US regulators were forced to intervene to close the bank to limit further damage.

Immediate impact

The good news is that The Federal Deposit Insurance Corporation (FDIC) has announced plans to reimburse customers with less than $250k within days.

However, the bad news is that SVB is not your average bank. Most of its customers are companies, funds, and high-net-worth individuals, which means that 93% of customers are uninsured for most of their deposits. While the FDIC plans to sell the bank's assets to reimburse them, it's uncertain how long this process will take and how much customers will receive over the insured $250k.

Despite the reimbursement plan, concerns remain for companies that bank with SVB. Many fear they cannot make payroll in the coming weeks if their deposits remain locked up with SVB. If this were to happen, it could lead to a broader economic collapse, starting with the tech industry.

Will this cause a financial crisis?

Reportedly, almost half of all US startups are associated with SVB. This contagion could have a catastrophic impact on the already flailing tech industry. The aftermath could adversely affect the broader economy, harming investors and adjacent industries.

Contagion: when a problem in one part of the financial system spreads to others, causing a domino effect of economic stress and instability.

In finance circles, you often hear about "black swans". For the first time in a long time, maybe since the collapse of Lehman Brothers during the great financial crisis or the onset of the pandemic, we may be looking at an actual black swan event.

Black Swan: an unexpected and rare event that has a severe impact on the economy or financial markets.

Investors may feel like they are in a horror movie, knowing the killer lurks around the corner. The financial sector's shares are falling, US and European markets are down across the board, the dollar is weakening, and cryptocurrency markets are taking a significant hit.

Fasten your seatbelts because it's going to be a bumpy ride!

Impact on crypto

Speaking of bumpy rides, the crypto industry was already on edge after the collapse of Silvergate Bank recently, which had almost 900 institutional investors and 94 crypto exchanges as clients.

However, the situation has worsened as Circle, the company behind the second-largest crypto stablecoin USD Coin (USDC), announced on Twitter that $3.3 billion of its $40 billion USDC reserves were held with SVB. Consequently, investors have redeemed over $1 billion in USDC tokens, causing the stablecoin to lose its dollar peg and Binance and Coinbase to suspend trading temporarily.

Stablecoins: cryptocurrencies designed to have a stable value by being pegged to a stable asset like a fiat currency.

If the stablecoin were to lose its peg due to the collapse of SVB, it could have disastrous consequences for the industry. Last year, the depegged stablecoin UST caused the collapse of LUNA, and its impact is still being felt today, with the behemoth crypto exchange FTX being one the latest victims of the fallout.

At this point, you start to wonder if we should rename them to 'unstable coins’.

It’s currently unclear how many crypto projects are exposed to SVB and the ongoing contagion from Silvergate. Some companies, including Binance, Tether and Gemini, have denied involvement with the failed bank. Still, none will announce it lest they risk a bank run-like scenario for themselves, with investors clamouring to jump ship.

Final thoughts

SVB had a uniquely heightened exposure to the tech industry, which is suffering from rising interest rates making it difficult to raise funds. As the saying goes, "don't put all your eggs in one basket", especially if that basket is full of tech startups.

This might offer some comfort that SVB is a relatively isolated event rather than indicative of another great financial crisis like Lehman Brothers in 2008. However, this raises broader concerns about the fractional reserve banking system - it works well until it fails, and when it fails, it can be catastrophic.

Many people have turned to crypto as an alternative to the fractional reserve banking system, but as we often see, the volatile industry could be one of the primary victims of the fallout.

We have yet to see if the US government will step in to protect companies banked with SVB. But the shockwaves have already begun to spread across the tech sector, causing instability and anxiousness regarding contagion. But if this is the black swan we fear it might be, the fallout could be far wider reaching.

Fasten your seatbelts.

Update - 13 March 2023

Since this post, there have been rapid changes:

The FDIC has reportedly taken action to secure all deposits, insured and uninsured, with a nationwide guarantee in the USA.

HSBC has acquired SVB's UK branch for £1 and promised to provide the necessary resources to aid its recovery.

These recent events suggest any fallout can be contained, and we can avoid the black swan scenario discussed earlier.

Great and well written article! Things seem to be changing quick but thankfully, from your article and what else I'm reading, it looks like the fallout from the collapse of SVB will be nowhere near on the scale of 2008 🤞